Institutional Insight: Deutsche Bank Investor Flows & Positioning 18/2/26

Gauging the Impact of Larger Tax Refunds on Equity Flows

Seasonal Trends in US Equity Fund Inflows

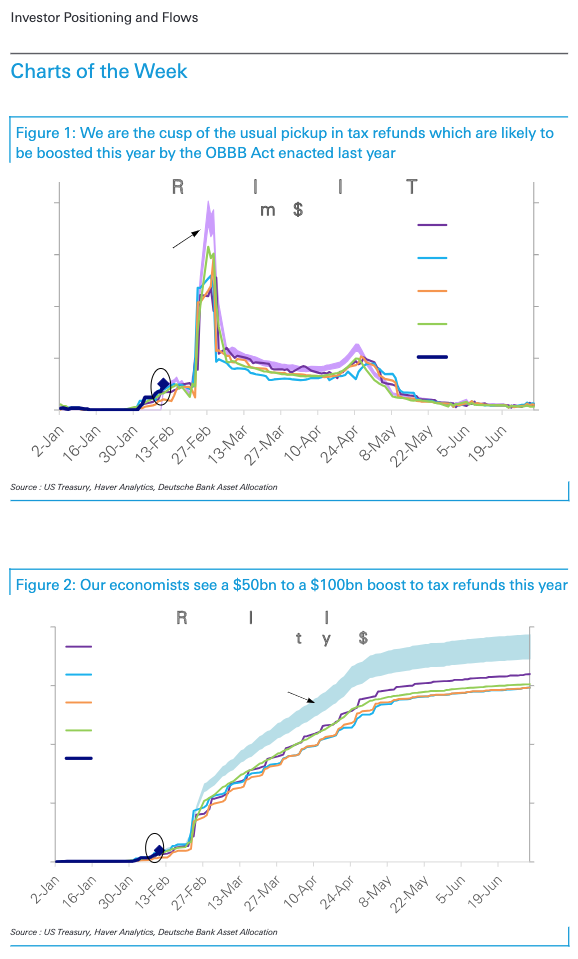

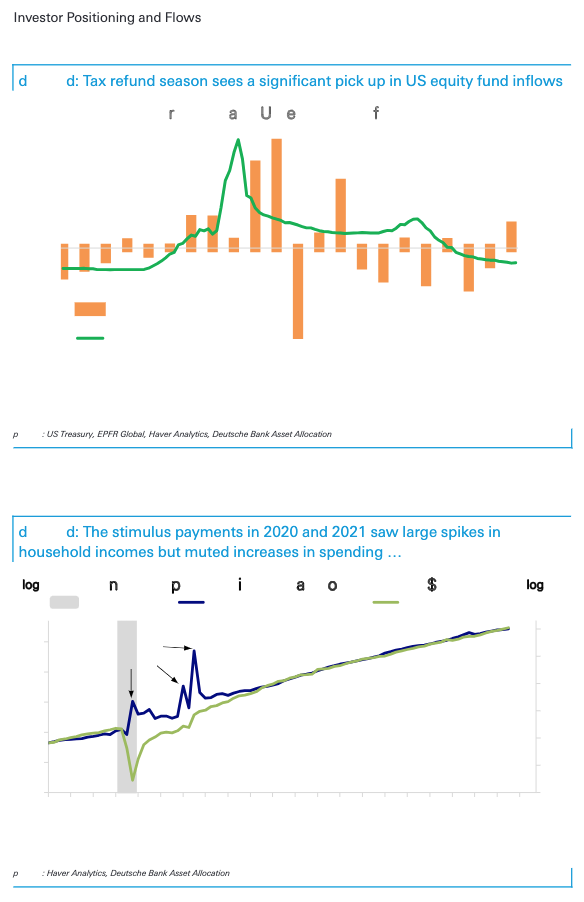

Historically, US equity fund inflows experience a notable uptick during tax refund season, which spans from mid-February to mid-April. This period typically accounts for approximately one-third of the annual equity inflows, with "normal" weekly inflows averaging around $11 billion. The disbursement of tax refunds drives this seasonal trend, providing individuals with additional funds to allocate towards investments.

Potential Amplification from Increased Tax Refunds

This year, tax refunds are expected to see a significant boost, with estimates ranging from an additional $50 billion to $100 billion, as highlighted by our US economists and consumer analysts (Market and Consumer Implications of the One Big Beautiful Bill Tax Cuts, February 4, 2026). This increase could potentially amplify the seasonal rise in equity inflows. The additional funds may also drive consumer spending, benefiting certain companies, as evidenced by the strong performance of consumer stocks over the past three months.

Drawing from prior stimulus events, such as the 2021 surge in equity inflows (Record Equity Inflows, January 2021), there is precedent for a portion of these funds being directed toward financial markets. Surveys conducted during that period (The Retail Wave: A Survey, February 2021) indicated that approximately 25% of stimulus payments were used for consumption, 35%–40% were allocated to financial assets, and the remainder went toward debt repayment.

A Modest Boost Expected* However, the magnitude of this year's tax refund-driven boost is likely to be more modest compared to the 2021 stimulus episode. The expected additional $50 billion to $100 billion in refunds is significantly smaller than the $450 billion in stimulus payments distributed in 2021. Furthermore, the unique conditions of early 2021, such as limited physical mobility during the pandemic, created an environment conducive to retail investor participation in financial markets. As the economy reopened, retail investor activity declined (Retail Retreats As Reopening Gathers Pace, March 2021).

If historical patterns persist, an estimated $20 billion to $40 billion of the additional tax refunds may flow into financial assets, with a portion directed toward US equities. While these inflows are directionally positive, the overall impact on equity markets is expected to be modest. It is also important to note that while increased financial capacity can support equity inflows, factors such as growth fundamentals and investor risk appetite play a significant role in determining the extent of market participation.

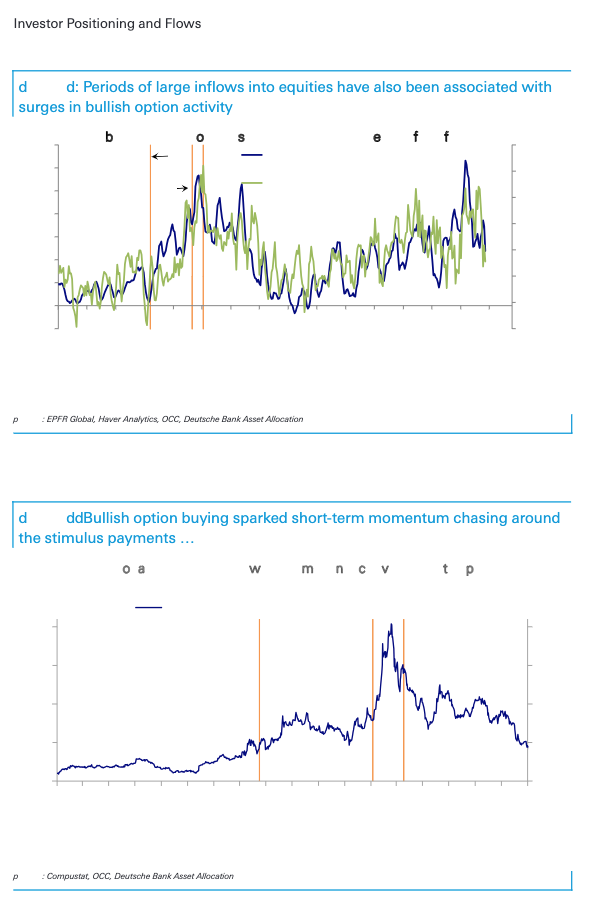

The impact on equities could be more pronounced if it triggers increased bullish options activity, particularly in areas susceptible to short-term momentum chasing. Historical data shows that prior stimulus payments and other periods of substantial equity inflows have often correlated with spikes in bullish options trading, amplifying the effects on equities (Where Are Call Volumes Concentrating? Jan 2021).

This phenomenon has been most noticeable among volatile, high-beta stocks of unprofitable companies, especially those with significant short interest. These stocks have frequently experienced bursts of short-term momentum chasing, as observed most recently between September and early October last year (Pockets Of Momentum Chasing, Sep 2025). A curated list of stocks meeting these criteria is available upon request.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!