SP500 LDN TRADING UPDATE 18/2/26

SP500 LDN TRADING UPDATE 18/2/26

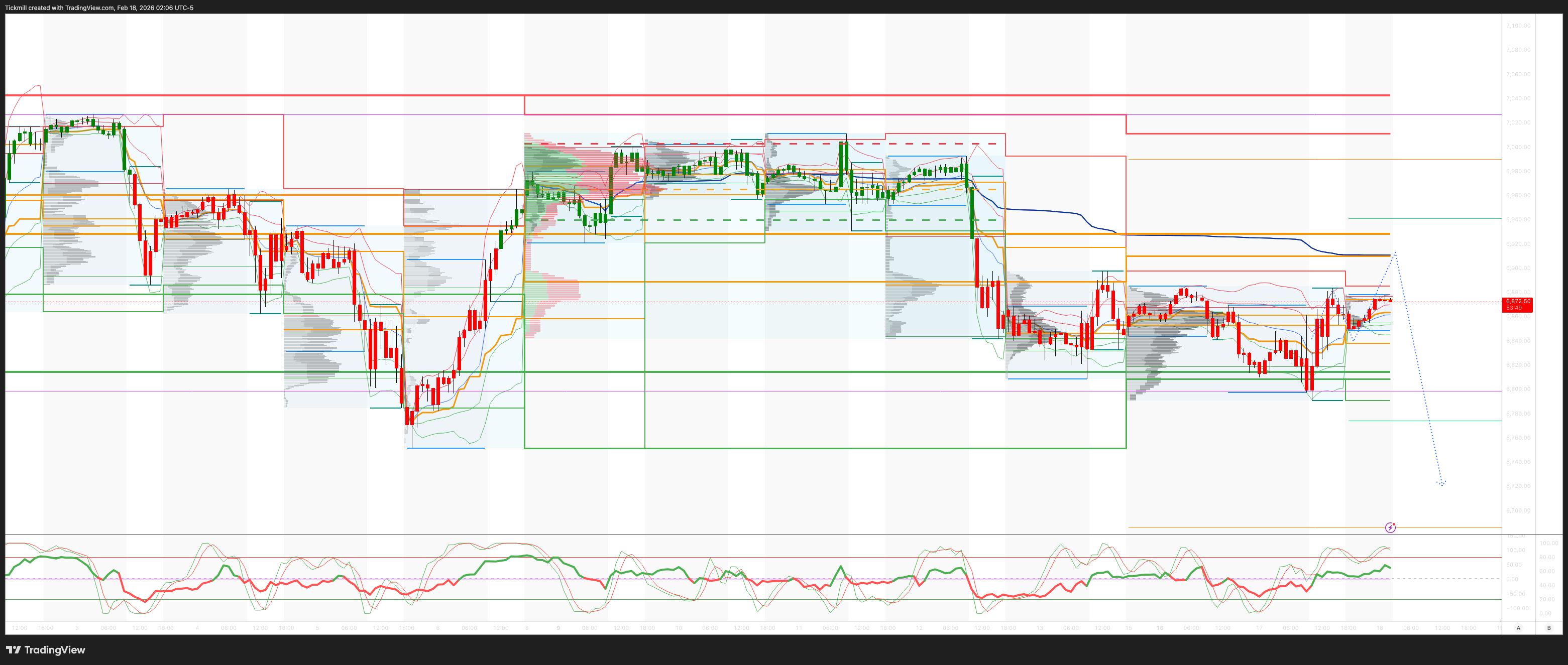

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 6980 SUP 6720

FEB EOM Straddle indicates a range of 214.6 points, suggesting a monthly FEB range of [6725, 7154].

FEB OPEX Straddle shows a range of 213.6 points, leading to an OPEX to OPEX range of [6726, 7154].

MAR QOPEX Straddle offers a range of 368.55 points, resulting in a range of [6466, 7203].

The range from DEC2025 OPEX to DEC2026 OPEX is 945 points, providing a range of [5889, 7779].

DAILY VWAP BEARISH 6876

WEEKLY VWAP BEARISH 6928

MONTHLY VWAP BULLISH 6865

DAILY STRUCTURE – ONE TIME FRAMING LOWER - 6883

WEEKLY STRUCTURE – ONE TIME FRAMING LOWER

MONTHLY STRUCTURE – TBC

DAILY RANGE RES 6924 SUP 6801

GAMMA FLIP 6945

2 SIGMA RES 6986 SUP 6740

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.46 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

SHORT ON REJECT/RECLAIM WEEKLY BULL BEAR ZONE TARGET 6720

LONG ON REJECT/RECLAIM OF WEEKLY SUP TARGET WEEKLY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - ‘Nowhere To Hide’

S&P closed +10bps at 6,843 with a Market On Close (MOC) buy imbalance of $2bn. NDX declined -13bps to 24,702, R2K remained unchanged at 2,647, and the Dow rose +7bps to 49,533. Total US equity exchanges traded 17.74b shares, below the YTD daily average of 19.53b shares. VIX dropped -410bps to 20.33, WTI Crude fell -100bps to $62.26, US 10YR yield edged up +1bps to 4.06%, gold slid -233bps to 4,876, DXY gained +23bps to 97.14, and Bitcoin dipped -164bps to $67,698.

The market experienced another choppy session with flat indices and no significant sector tilts, reflecting mixed signals of 'risk on' and 'risk off.' Activity levels were notably subdued compared to last week, with the market revisiting the AI disruption theme. ETF tape remains elevated at 38% (YTD avg is 32%), while exchange and S&P volumes were down -12% versus the 20-day average. Liquidity continues to be weak, with S&P top-of-book average at $4.06mm, well below the 1-year average of $11.51mm.

Post-market highlights included PANW (-5%, was +4%) following a mixed F2Q beat with complexities around Chronosphere and CyberArk. M&A activity saw notable announcements:

1) ZIM surged +25% after announcing a definitive merger agreement with Hapag-Lloyd for $35/share.

2) KW gained +10% on its definitive merger agreement with a consortium led by William McMorrow and Fairfax Financial for $10.90/share.

3) WBD rose +3% and PSKY +4% as deal talks reopened after Paramount increased its offer to $31/share, though it stated this was not its "Best and Final." WBD has until February 23rd to engage with PSKY and will hold a shareholder vote on March 20th.

4) HOLX remained unchanged as Blackstone's acquisition received European Commission approval.

5) GPC dropped -15% amid plans to separate its auto-parts and industrial-parts businesses into two public companies.

6) MASI soared +35% following reports from WSJ that Danaher is nearing a $10bn acquisition deal for the medical device company.

Floor activity was rated 4/10, with overall activity levels down. The floor finished -160bps for sale versus a 30-day average of -42bps. Asset managers were net sellers by $1bn, driven by supply in macro, discretionary, and communication services sectors, while financials saw demand. Hedge fund flows were flat, with supply in financials offset by demand in energy and discretionary sectors.

In derivatives, the market continued to experience significant intraday swings due to poor liquidity conditions. Rallies faced fresh gamma supply, while dealers moved shorter gamma during sell-offs. Market tension remains high, with the panic index hovering around 8.6. Index hedges were active early but slowed throughout the day. Investors appear cautious about rallies, with S&P volatility bid at the front end and short-dated skew under pressure. Heading into VIX expiry tomorrow, demand for 1-month variance seems weak at current levels. The straddle for the short week closed around ~1.42%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!