FTSE 100 FINISH LINE 17/11/25

FTSE 100 FINISH LINE 17/11/25

London's stock market started the week on a slightly sour note, with losses driven by a weaker financial sector amid a packed schedule of critical economic updates. By midday on Monday, the FTSE 100 index of blue-chip companies had dipped, heading for its third straight day of declines. Meanwhile, the FTSE 250, which tracks mid-sized companies, dropped, marking its fourth consecutive session in the red. Last week ended on a rough note for UK markets after news broke that Reeves might reverse a planned tax hike, which sent government bond yields soaring. Now, all eyes are on this week’s UK inflation data, which could influence both the upcoming budget and the Bank of England’s decision on interest rates ahead of its December 18 policy meeting. Globally, investors are also watching closely for U.S. jobs data and quarterly earnings from AI leader Nvidia.

Back in the UK, mining stocks took a hit, falling 0.9% as copper prices softened. The banking sector was one of the biggest drags on the market, falling 0.8%. Major players such as Barclays, HSBC, and Standard Chartered saw their shares slide between 0.7% and 1%. On a brighter note, advertising giant WPP surged 5% after The Times reported that French competitor Havas and private equity firms Apollo and KKR had expressed interest in a potential takeover. However, it wasn’t all good news. The Construction & Materials sector fell 1.2%, following a report from property website Rightmove that revealed a significant drop in UK house prices—down 1.8% in the four weeks leading up to November 8. This marks the steepest fall for this time of year since 2012. Adding to the sector’s challenges, reports suggest that Finance Minister Rachel Reeves plans to introduce a tax on high-value homes as part of her November 26 budget announcement.

In company-specific news, HICL Infrastructure tumbled 7.3% after announcing a £3.98 billion ($5.2 billion) merger deal with The Renewables Infrastructure Group. Meanwhile, Genuit, a water solutions manufacturer, plunged 13.2% after issuing a profit warning for the full year that fell short of market expectations. With so much at play this week—from inflation reports to major corporate updates—the market is bracing for what could be a volatile few days ahead.

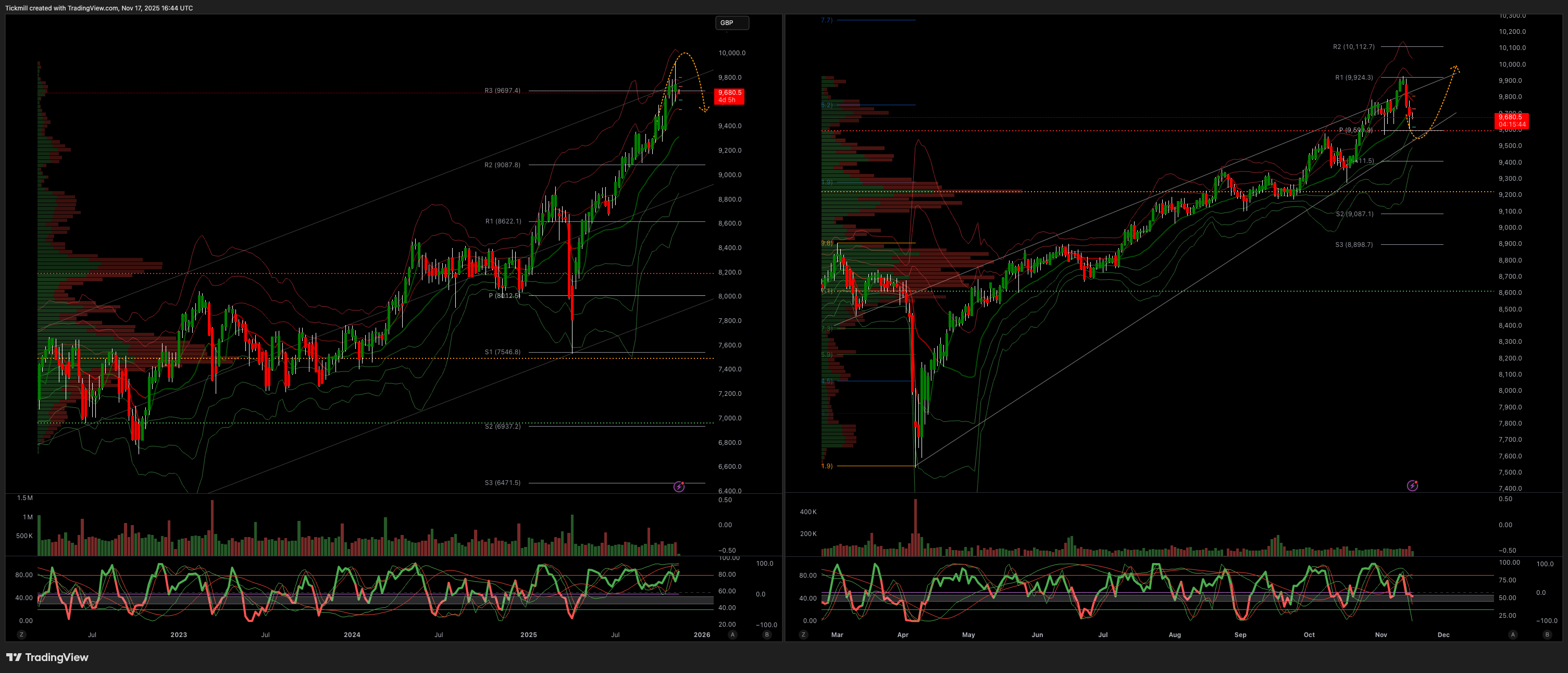

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish

Weekly VWAP Bullish

Above 9781 Target 9945

Below 9711 Target 9602

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!